tax shield formula excel

How to calculate tax shield due to depreciation. Interest Tax Shield Interest Expense x Tax Rate.

Tax Shield Formula How To Calculate Tax Shield With Example

TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE.

. This reduces the tax it. As such the shield is 8000000 x 10 x 35 280000. Formula and Excel Calculator.

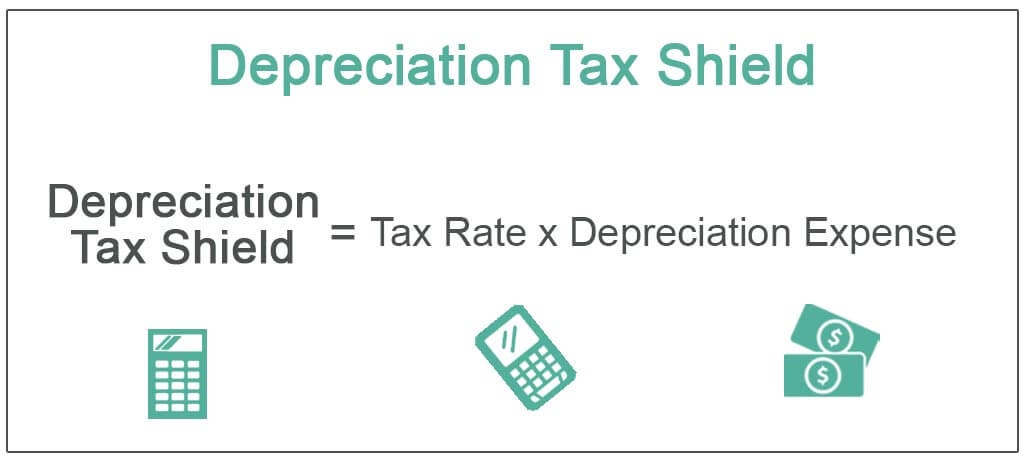

Yield Function in Excel. The Depreciation Tax Shield in 2 Steps. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

1-046 24 1-046 25 of between 24 and 25 pre-tax. Depreciation Tax Shield Formula. Ad Find Deals on download turbotax deluxe 2021 in Software on Amazon.

Investment Cost Marginal Rate of Income tax Rate of Capital Cost Allowance xl ry Rate of Return Alffilfftq x 1 Rate of Return. Interest Tax Shield Formula. The intent of a tax shield is to defer or.

As such the shield is 8000000 x 10 x 35 280000. Super Easy To Get Up and Running. How to Calculate Tax Shield.

Tax Shield Deduction x Tax Rate. . How to calculate after tax salvage valueCORRECTION.

For more resources check out our business templates library to download numerous free. The effect of a tax shield can be determined using a formula. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒.

Free Case Review Begin Online. The APV approach allows us to see whether adding more debt results in a tangible increase or decrease in value as well as enables us to. To learn more launch our free accounting and finance courses.

A company carries a debt. The interest tax shield can be calculated by multiplying the interest amount by the tax rate. Tax Shield Deduction x Tax Rate.

Ad Best Average Rating For Customer Support. Interest Tax Shield. In this video on Tax Shield we are going to learn what is tax shield.

In the line for the initial cost. This is usually the deduction multiplied by the tax rate. The remaining asset value at the end of its useful life from the assets purchase.

FREE INVESTMENT BANKING COURSE Learn the foundation of Investment banking financial modeling valuations. Ad Based On Circumstances You May Already Qualify For Tax Relief. Measuring and Managing the Value of Companies.

See If You Qualify For IRS Fresh Start Program. Tax shield Pre-tax Income adjd Tax rate Net Income Net Cash Flow PV of Net Income Discount rate Total NPV of Income Pre-tax Note. Depreciation Tax Shield Formula Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie.

This is equivalent to the 800000 interest expense multiplied by 35. However adding back the protection is not. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

How to calculate NPV. The effect of a tax shield can be determined using a formula. Tax shield formula excel.

Tax shield formula excel. Interest Tax Shield Example. Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k.

This is usually the deduction multiplied by the tax rate. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

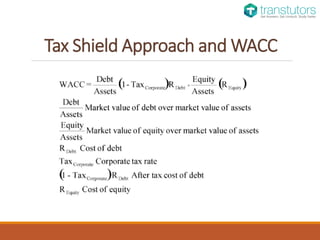

Understanding The Weighted Average Cost Of Capital Wacc By Dobromir Dikov Fcca Magnimetrics Medium

Depreciation Tax Shield Formula Examples How To Calculate

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Tax Shield Formula How To Calculate Tax Shield With Example

The Tax Shield Approach Assuming That The Capital Chegg Com

Tax Shield Definition And Formula Bookstime

What Is A Depreciation Tax Shield Universal Cpa Review

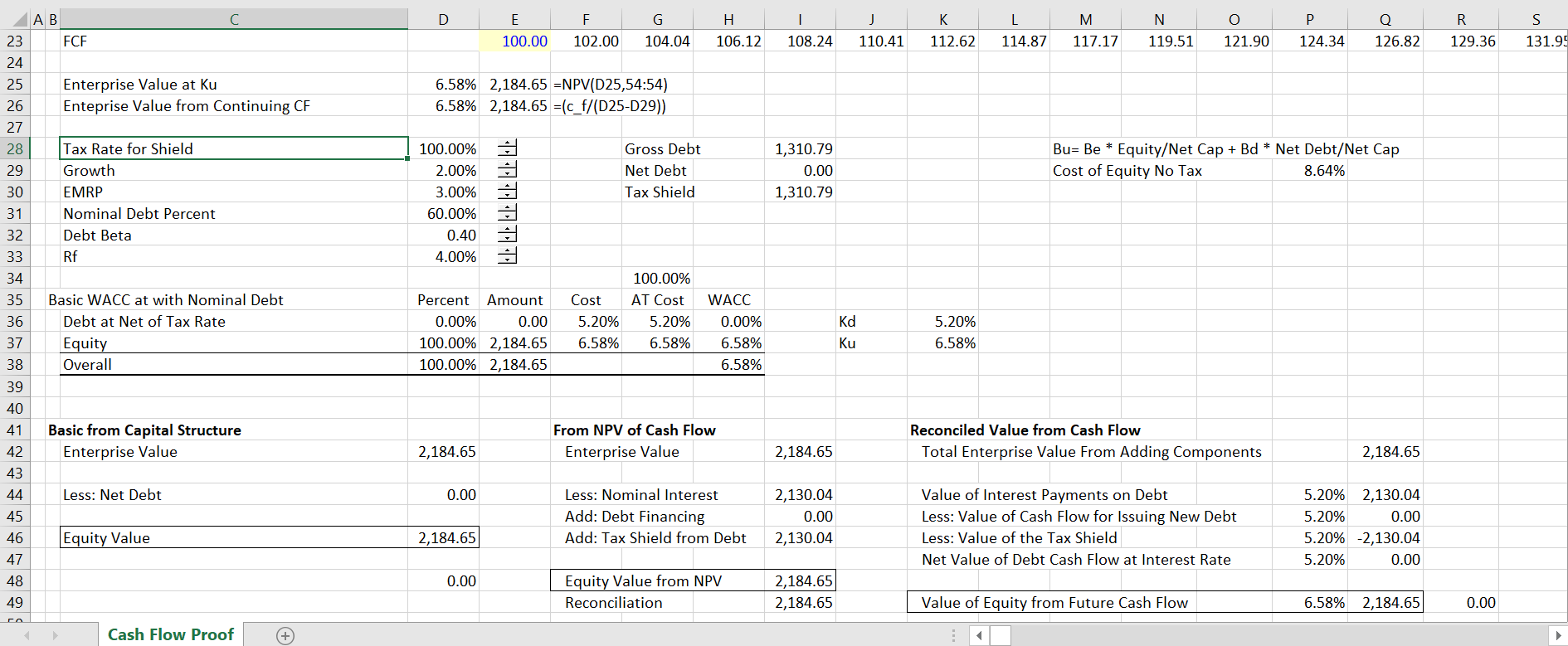

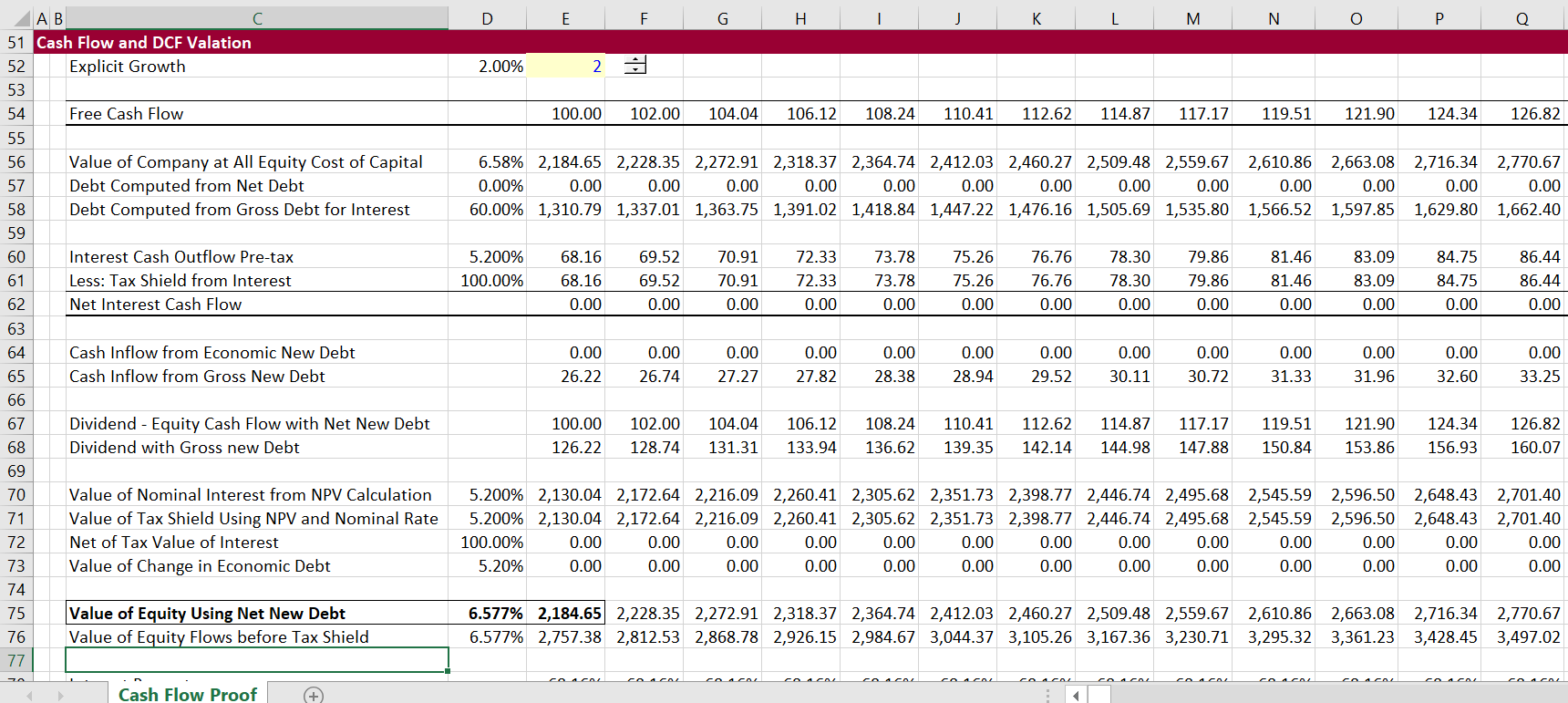

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Tax Shield Definition Example How Does It Works

Tax Shield Definition Formula Example Calculation Youtube

How To Npv Tax Shield Salvage Value Youtube

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shields Financial Expenses And Losses Carried Forward

Using Apv A Better Tool For Valuing Operations

Tax Shield Formula How To Calculate Tax Shield With Example

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity